One of the most common and unavoidable types of stress in leadership is financial stress.

But since the signs are subtle, and because it’s common, it sometimes goes unnoticed until it’s too late and has already taken a toll on you.

Hence, recognizing the signs and understanding how they manifest in leadership roles is vital to prevent drastic effects.

SIGNS OF FINANCIAL STRESS

1. Unusual Behavioral Changes such as increased irritability, withdrawal, or difficulty concentrating.

2. Changes in Decision-Making Patterns like noticeable alterations in decision-making processes, like hesitation, indecisiveness, or a sudden aversion to risk.

3. Impact on Interpersonal Relationships including strained relationships with team members, colleagues, or superiors, potentially stemming from heightened stress.

4. Physical and Emotional Well-being such as increased absenteeism or signs of burnout.

Remember, identifying signs of financial stress is the first step towards fostering a supportive environment for leaders. By recognizing these indicators, we can proactively work towards alleviating the impact of financial stress on leadership effectiveness.

But before recognition, an important step is prevention. And in prevention, strategies are a must. Below, you’ll find actionable strategies to prevent financial stress.

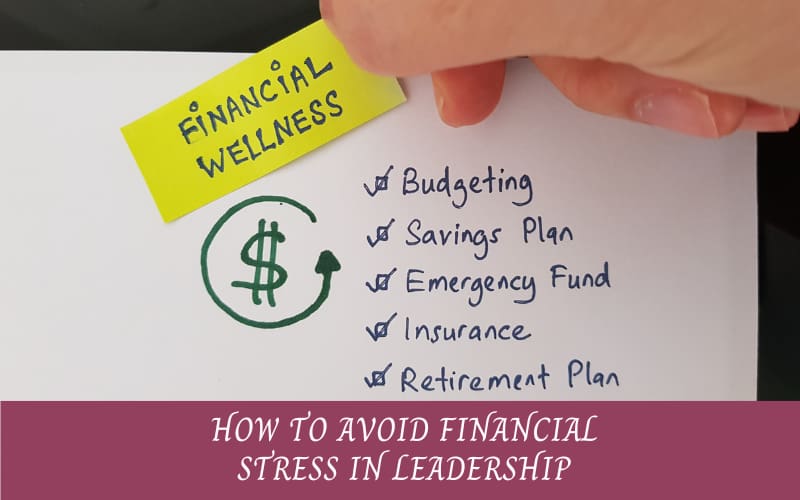

Strategies for Financial Wellness in High-Pressure Environments

Managing financial wellness is a critical aspect often overshadowed by the demands of the role. But financial stress is one of the types of stress that we’d all want to avoid. This subtopic dives into practical financial management tips tailored for leaders navigating high-pressure environments.

1. Budgeting for Leadership Success:

Practical Tip: Develop a leadership-centric budget that aligns with the unique financial demands of your role.

High-Pressure Context: Explore how effective budgeting can alleviate stress and provide financial clarity amidst high-pressure situations.

Real-Life Example:

John Chambers, former CEO of Cisco Systems, emphasized the significance of budgeting during challenging times. Through strategic financial planning, he guided Cisco through economic downturns, showcasing how a well-structured budget can be a pillar of stability in high-pressure leadership roles.

2. Strategic Debt Management:

Practical Tip: Implement strategies for managing and reducing debt while balancing leadership responsibilities.

High-Pressure Context: Understand how strategic debt management contributes to long-term financial well-being, even in the face of high-pressure situations.

Real-Life Example:

Dave Ramsey, a well-known financial expert and CEO, faced financial stress early in his career. Through disciplined debt management and financial education, he not only recovered but built a successful enterprise centered around financial wellness.

3. Investment Mindset for Leaders:

Practical Tip: Cultivate an investment mindset that aligns with leadership goals and timelines.

High-Pressure Context: Explore the connection between an investment mindset, leadership decisions, and financial resilience in high-pressure environments.

Real-Life Example:

Warren Buffett, renowned as one of the most successful investors and CEO of Berkshire Hathaway, exemplifies the power of an investment mindset. His strategic approach to investments and long-term vision have played a crucial role in both his leadership success and financial resilience.

4. Emergency Fund Practices:

Practical Tip: Establish and maintain an emergency fund specifically designed for leadership roles.

High-Pressure Context: Discuss the importance of having financial buffers in place to navigate unexpected challenges without compromising leadership effectiveness.

Real-Life Example:

Mary Barra, CEO of General Motors, understands the significance of an emergency fund. During periods of industry challenges, having a financial buffer allowed General Motors to weather the storm under her leadership.

Now, why do we need to implement these strategies? We don’t want financial stress to take a toll on our mental health after all, don’t we?

The Interplay Between Financial Stress and Mental Health

In leadership, the interplay between financial stress and mental health is often underestimated. Here, we will go through the psychological effects of financial stress on mental health and how it influences leadership effectiveness.

1. Cognitive Impact of Financial Stress:

Financial stress can impact cognitive functions, such as decision-making, problem-solving, and creativity. Just like general stress, financial strain can create a mental fog, making it challenging for leaders to navigate complex decisions and think innovatively. The burden of financial stress often occupies valuable mental bandwidth, diverting attention from strategic planning to immediate concerns about financial stability.

Real-Life Example:

Elon Musk, CEO of Tesla and SpaceX, publicly acknowledged the cognitive toll of financial stress during Tesla’s early struggles. Musk highlighted how the burden impacted his ability to make strategic decisions and underscored the importance of addressing mental health for sustained leadership success.

2. Emotional Well-being Amidst Financial Challenges:

Financial stress can also affect emotional well-being, leading to increased levels of anxiety, depression, or burnout. The weight of financial concerns can cast a shadow on a leader’s emotional landscape, impacting their overall mental health. The constant pressure to meet financial obligations and navigate uncertainties can contribute to heightened stress levels, potentially leading to emotional challenges.

Real-Life Example:

Sheryl Sandberg, Facebook COO, openly discussed the emotional toll of financial challenges following the sudden death of her husband. Her experience emphasizes the need for leaders to prioritize emotional well-being amidst financial adversity.

3. Long-term Effects on Leadership Effectiveness:

Aside from mental and emotional effects, it also has a long-term impact of sustained financial stress on a leader’s overall effectiveness. The chronic nature of financial stress can seep into various aspects of leadership, affecting decision-making, strategic planning, and the ability to inspire and guide a team. Over time, the constant juggling of financial challenges can erode a leader’s resilience and enthusiasm, potentially hindering their capacity to steer the ship with the same vigor and effectiveness.

Real-Life Example:

Warren Buffett, renowned CEO of Berkshire Hathaway, faced financial challenges early in his career. The perseverance he demonstrated in overcoming these hurdles showcases the long-term impact of sustained financial stress on leadership effectiveness. Buffett’s journey underscores the importance of resilience and strategic financial management in navigating the complexities of leadership over the years.

Open Conversations: Breaking the Stigma Around Financial Struggles

In the realm of leadership, a culture of silence often shrouds discussions about financial struggles. The fear of judgment and its potential impact on professional reputation can be a significant hurdle.

However, embracing openness about financial challenges is a gradual process. Leaders can start by initiating small, focused discussions within trusted circles, creating a safe space to share experiences.

One exemplary company leading the charge in destigmatizing financial struggles is Google.

Through employee resource groups focused on financial wellness, Google has created a platform for leaders to engage in discussions without fear of judgment. This initiative has not only fostered empathy but also strengthened connections among leaders.

Establishing support networks where leaders feel comfortable sharing their personal financial experiences presents its own set of challenges. However, mentorship programs that include financial well-being as a discussion point can serve as a workaround. This approach helps leaders connect on a deeper level, reducing isolation, and providing a platform for collective problem-solving.

Indra Nooyi, former CEO of PepsiCo, serves as an inspiring example. She actively advocated for open discussions on financial challenges, emphasizing the value of mentorship and peer support.

By breaking down barriers to discussing financial well-being, Nooyi contributed to a more supportive and connected leadership community.

Providing accessible and relevant financial education tailored for leaders is another crucial aspect.

Collaborating with financial experts to create targeted resources and workshops specifically designed for leadership audiences addresses this challenge.

Salesforce, for instance, offers financial wellness programs for its leadership team, supporting them in navigating financial challenges and contributing to a healthier work environment.

While breaking the stigma around financial struggles poses challenges, the positive rewards, exemplified by forward-thinking companies and leaders, showcase the transformative impact of fostering open conversations.

Now that we have the strategies for prevention and can recognize the signs, we must also have long-term solutions to sustain our long-term financial sustainability.

Long-Term Solutions for Sustainable Financial Health

1. Holistic Financial Planning:

Embrace holistic financial planning that encompasses short-term and long-term goals. Consider diversified investments for balanced growth, establishing leadership-specific emergency funds for unforeseen challenges, and integrating a robust retirement plan for financial confidence in the future.

2. Investment in Continuous Learning:

Promote a culture of continuous learning, encouraging leaders to stay informed about financial trends and strategies, and fostering adaptability and informed decision-making for a robust long-term financial strategy.

3. Mentorship for Financial Guidance:

Encourage leaders to seek mentorship for ongoing financial guidance throughout their careers, ensuring a lasting foundation for long-term financial health through personalized insights, strategic counsel, and continuous support.

A sustained financial health for leaders requires a proactive and integrated approach that aligns with the dynamic nature of leadership roles.

Conclusion: Nurturing Financial Well-being in Leadership

In the dynamic landscape of leadership, recognizing and addressing financial stress is crucial.

Real-life examples, from Elon Musk’s cognitive challenges to Sheryl Sandberg’s emphasis on emotional well-being, underscore the transformative power of financial wellness.

By breaking the stigma, fostering open conversations, and embracing holistic planning, continuous learning, and mentorship, leaders can navigate financial challenges with resilience.

Let these insights, plus more of these, guide you toward sustained financial health, ensuring a journey marked by confidence, wisdom, and long-term success!